BlockCerts Use Case Desk: Top 4 Small Business Pain Points for Employer Firms

Many people have a dream of opening up their own business. Whether it’s a cozy coffee shop, a boutique-clothing store, or an innovative startup, the process of building your own business provides an opportunity to bring your passion project to life. It’s an empowering experience, though; it certainly doesn’t come without its ups and downs.

Running a small business is tough. In fact, most would agree that it’s one of the most trying endeavors they’ve faced. Just ask any of the 173 million small businesses (as shown from IFC /World Bank). Add-in mid to enterprise businesses and that’s your competition – stressful!

Many entrepreneurs find some universal challenges that they are likely to face on this journey. Here, we round up the top four small business pain points that you and your employees are currently facing or may face in the future and how the blockchain can lend a helping hand”.

The Federal Credit Survey Report

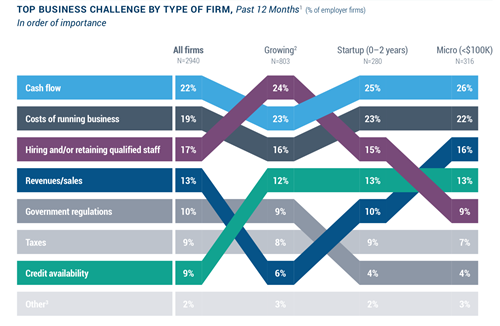

In collaboration with seven Federal Reserve Banks, the recent Small Business Credit Survey sheds some light on the challenges that small business owners are confronting today. The 2015 report pulls from the survey responses of 3,459 employer firms from 26 states and focuses on three sub-segments—startups, microbusinesses, and growing firms. Overall, the scope of this survey offers insights on business conditions from the perspective of the small business owner.

Number One: Cash Flow

One such insight is that cash flow is a common challenge for small businesses. In fact, 22% of all employer firms report that managing cash flow is their top business challenge. This number increases across different business sub-segments as well:

Growing Business: 23%

Startup (0-2 Years): 25%

Micro Business (<$100K): 26%

It’s hard to keep control of cash flow when you’re paying for multiple solutions to support your business. The average business owner pays $780 a year or more for their cloud-based software. What’s worse is that this only accounts for one person. Seat Fees are fixed per person and if you have four employees plus yourself, that’s 5 x $780 = $3,900 a year in expenses.

You sign up for Last Pass to protect your passwords, that’s $3 a month that adds up over time. Then, if you sign up for DropBox or another eSig platform, that’s $480 a year which will continue charging you month after month, and year after year. Now, you’re paying for a service that you may not even be using. Even if you do 24 contracts a year, that still breaks down to $20 per contract. Talk about crippling your cash flow!

The Blockchain Solution

Luckily, the blockchain shifts this entire paradigm. What if you only paid for what you really used, all at a fraction of the cost? What if you were able to eliminate the majority of those services and improve your cash flow with one quick change? What would you do with all of that extra money in your account? Here at BlockCerts, we live by the same motto, “Just say no to seat fees.” By downloading BCERTin, you’ll join in on the revolution and see very quickly how your credit card statement will be changed for the better.

Number Two: Cost of Running a Business

Similar to cash flow, the cost of running a business is a headache for many business owners and according to the report, 19% of all firms say that this is the top business challenge. When it comes down to it, it’s expensive to run a business even before you bring in revenue. In order to keep the revenue and customers, it becomes even more expensive and as you add new hires, vendors and contractors to the mix, it seems as if there’s no end in sight.

The Blockchain Solution

Another large cost that plagues small businesses is the pain of lawsuits, disagreements, charge-backs and attorney costs. While disagreements happen, there is a better way to secure trust in a business setting. Leveraging smart contracts, you may attach your documents and supporting conversations to review any disagreement before it becomes an attorney issue. You’ll have better customer relationships, better vendor relationships and with better relationships comes more opportunities and revenues in the future.

Number Three: Hiring and Retaining Quality Staff

Another key insight that we learned from the 2015 Small Business Credit Survey is that talent is a significant challenge for growing firms. In fact, 24% said that finding and retaining qualified staff is their top challenge. Hiring, training, and retaining employees is a constant cycle that keeps us from getting down to business. There’s the cumbersome paperwork, the complex on-boarding process, and all of the training information that’s needed to get your employees up to speed. It’s a weighty process and it requires a strong model to bring to seamless completion.

The Blockchain Solution

With BlockCerts, you’ll provide employees with a quick way to sign up, upload critical documents, sign off on agreements, and obtain training materials for an easy transition into the company. You’ll onboard all employees the same way and create a great first impression to solidify the relationship. Once they have settled into the company and shown a job well done, you can even send a three-month anniversary bonus or other automated items to keep your employees happy. Because by automating some of those processes, you’ll retain your employees more effectively and have more time to work in your business and on your business.

Number Four: Revenues/Sales

13% of businesses cite revenues/sales as a top challenge as well. In any business, time is money and unfortunately, many business owners are wasting too much time. In running a small business, you have to be all things to all people. You have to be an accountant, a service person, a salesperson, a marketing and legal professional, and the list goes on. Time management is critical and many businesses are losing time by playing the waiting game.

Think about the last time you completed a contract. You sent an email with a contract, you waited to get an email response and then had to follow-up with a call to see if they had even received your contract. When you finally heard back, several changes needed to be made and you had to start the whole process all over again with more back and forth and more wasted time.

The Blockchain Solution

What if instead, you collaborated online? What if you could tell whether the person opened it or not? What if you made changes to the contract online with full visibility to the other party/parties involved? What if there was no more back-and-forth, just collaboration and getting the job done right, the first time? With BCERTin, your time becomes that much more valuable.

Solving the Business Equation

The business equation is simple. Better Relationships + More Time = More Sales. By leveraging blockchain solutions, you’ll find more opportunities to improve your bottom line and heal the inefficiencies that hold your business and your relationships back. The blockchain is here to transform business paradigms and we look forward to seeing how far it will take you and your business dream.